Taylor Scott International News

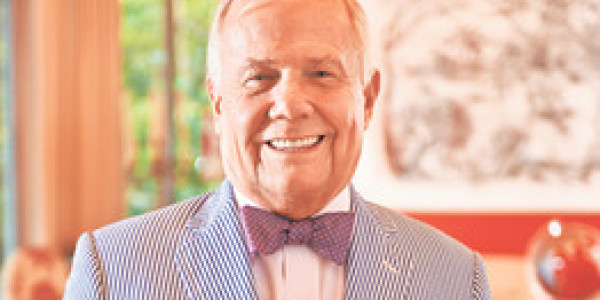

By KOPIN TAN An interview with investor and author Jim Rogers in Singapore. Why he likes agriculture and Chinese airlines, is concerned about currency turmoil and thinks young Americans should learn a foreign language. Stepping off a 19-hour flight to visit Jim Rogers in Singapore is a daunting proposition. First, you must locate his home, nestled in a particularly private, verdant nook nuzzling the 183-acre Singapore Botanic Gardens. Next, his remarkably poised 10-year-old daughter—the blond-haired, blue-eyed Hilton Augusta Parker Rogers, or Happy Rogers to her friends—quizzes you in flawless Mandarin to see if your language skills are up to snuff. Then, Rogers invites you to exercise with him while chatting about the markets. Rogers, who will turn 71 this week, has always been a multitasker. The co-founder (with George Soros) of the Quantum Fund famously retired at 37 to travel the world, and is today a venerable investor, author of six books, and doting dad. Convinced of Asia’s ascendance but put off by China’s pollution, he moved his family from New York to Singapore seven years ago so his two young daughters can grow up speaking Mandarin. Today, Oriental antiques jostle Barbie dollhouses for pride of place in his spacious home. He takes his daughters to school on a bicycle, even though a gleaming Mercedes with an 8888 license plate—eight being the most auspicious number to the Chinese since it sounds like the word for “prosper”—sits in the driveway. imageCJ Sameer Wadhwa/Getty Assignments for Barron’s “I cannot invest the way I want the world to be; I have to invest the way the world is.” — Jim Rogers . What follows is our very sweaty conversation—me from the equatorial humidity, Rogers from pedaling a recumbent stationary bike on the patio, a laptop dripping stock quotes propped on his handlebars. A tantalizing pool beckons from 10 feet away, but he did not once slow down. Barron’s : How do you like living in Singapore, and do you miss New York? Rogers: Singapore has the best of everything—great education, great health care, everything works here. It’s been an astonishing success story over the past 40 years. We’re very pleased here. When I was selling my New York house, I almost backed out; I just couldn’t bear the thought of leaving. But now I’m very happy here. I fly to New York and I realize I’m in a Third World airport. Then I get into a Third World taxi onto a Third World highway. The difference now just slaps me in the face. New York is a wonderful place, with the people and the vibrancy, but I can find the same vibrancy, if not more, in Asia. You’ve been a big proponent of China and emerging markets. What’s your world view these days? This is the first time in recorded history that we have all the major central banks, all the major governments actively debasing their currencies. Japan has said it will print unlimited amounts of money. So Ben Bernanke said, “Wait a minute, we can throw in a trillion dollars a year.” And the Europeans said they’ll do “whatever it takes.” There’s a gigantic ocean of liquidity, and the people getting that liquidity are having a wonderful time. But it’s totally artificial, and it’s going to end badly when it ends, I assure you. Can’t such policies go on for a while? After all, we still don’t have inflation… According to the U.S. government! But you must buy some things: insurance, food, even paper. The price of nearly everything is going up. We have inflation in India, China, Norway, Australia—everywhere but the U.S. Bureau of Labor Statistics. I’m telling you they’re lying. Go to a restaurant in New York, or a grocery store, and tell me that there’s no inflation. [Rogers starts tapping on his laptop]. Look here: In 2001, it cost $9 to go to the top of the Empire State Building. Now it’s $27 to go to the 86th floor, $44 to go to the top, and $67 to go express. The Museum of Modern Art in 2001 was $10, now it’s $25. A cab from Kennedy airport to Manhattan in 2001 was $30 plus tolls. Now it starts at $52. Should the market be near record highs? Or has it run ahead of the economy? Staggering amounts of money being printed has to go somewhere, and it frequently goes into financial markets. But the advance is getting narrower. Fewer and fewer big stocks are going up, which is what happened near the end of the last bubble in 1999. Now, I don’t know how long this will go on, but it can’t go on forever. That said, you can’t really short this market either. Are you bullish about anything? I think agriculture is going to be one of the best investments over the next few decades. The world has consumed more than it has produced for much of the last decade, so inventories are near historic lows. The average farmer is 58 in the U.S. and Australia, 66 in Japan. Old farmers are dying or retiring, and young people aren’t going into agriculture. Young Americans go into PR, not agriculture. Prices have to go much higher to attract labor, management, capital or we’re not going to have enough food in the long run. So how do you invest in agriculture? I could buy farmland and become a farmer—although I would be hopeless at it—or buy farmland and lease it out. Buy shares in farms, farm equipment, fertilizer and seed companies that trade on exchanges around the world. Stock markets in agriculture-producing countries should do better than those in agriculture-importing ones. Retailers, restaurants, banks in agricultural areas will do well. Buy a vacation home on a lake in Iowa, not Massachusetts. And there are listed indexes like the RJA or the RGRA. [The RJA, or Elements Rogers Agriculture Total Return exchange-traded note, tracks the Rogers International Commodity Index, which Rogers designed. The RGRA is the RBS Rogers Enhanced Agriculture ETN]. Capital has fled emerging markets as U.S. interest rates rise. Is it time to nibble? I’ve been shorting some emerging markets like India and Turkey. If you can only visit one country in your life, I urge you, plead with you, to go to India. It’s the most extraordinary country in the world for historic sights, breadth of culture, etc. But, boy, it’s a hopelessly managed place. Countries like India, Turkey, Indonesia that have big balance-of-trade deficits could easily finance things when there’s all this free money. But when people realize there won’t always be this artificial liquidity, then there’ll be problems. Other than that, emerging markets are doing OK. I was pessimistic about Russia for 46 years, and I think it’s becoming the second most-hated market in the world, after Argentina. But I see positive changes taking place, so I’m looking. I bought a few shares of an index, and a few shares of Aeroflot [ticker: AFLT.Russia] because I see positive changes taking place in airlines. I also like Myanmar. There aren’t many stocks you can buy there, and they’re just building a stock market. But Nok Airlines [NOK.Thailand] is a regional airline making inroads there. In the long run I’m excited about Myanmar. Among the Chinese companies I bought shares of after I became a director is New York-listed FAB Universal [FU], a small digital media company. [The company offers copyright-protected audio and video products, while a licensing segment lets consumers download copyrighted media.] The Chinese government has decided to promote and support its rich culture. One way to do that, and it’s a big job, is to become stricter about enforcing intellectual-property rights. Investors have become skeptical about China—the shadow banking system, infrastructure spending, etc. The market is well off its 2007 high. Are you concerned? In general, I don’t like to buy China except when it collapses. The last time I bought China in any significant way was in October, November of 2008. But if and when the market falls, I’ll buy. I’ve read all those skeptical stories about China for many years, and so far they haven’t come true. There will be setbacks: In the 19th century, as America was rising to power and glory, we had 15 depressions, virtually no human rights, little rule of law, massacres in the streets. We had a horrible civil war. You could buy and sell Congressmen in those days—you can still buy and sell Congressmen, but in those days they were a lot cheaper. Sure, China will have problems. But I’m not going to tell my children to switch over to Danish, because China is going to be the next great country in the world. You’ll see problems and setbacks, but if you can find the right industries, companies, people, you will do well. So where are those “right” industries and companies in China? Besides Chinese culture and copyright, the government is giving incentives to support agriculture and food production. Pollution is a nightmare in China, and they know it, so they’re spending lots of money trying to clean up the environment. Water is another huge problem—big shortages in the Northeast, it’s dirty and there’s not enough of it. Then there’s travel. For a long time, the Chinese haven’t been able to travel. Now, it’s easier to get a passport. When I first drove across China there were no highways, hotels, gas stations. Now you can get into a car and actually go somewhere. There’s still a high savings rate, but people are starting to spend more. Chinese tourism—both domestic and international—is going to be a staggering growth business for years to come. I own six or seven Chinese airlines because of that. The Chinese also are spending huge amounts of money on railroads, and their know-how is better than most people realize. So it’s an export market as well, and one company I like is Hollysys Automation Technologies [HOLI]. [Based in Beijing and listed on Nasdaq, Hollysys provides automation and control technology for railways, subways and other industrial customers in Asia and the Middle East.] With China slowly liberalizing its financial system, will you buy “dim sum” bonds, which are renminbi bonds offered in offshore markets like Hong Kong? I wouldn’t buy bonds because I expect interest rates everywhere will be going higher. I’m not optimistic about bonds long-term, although short-term they’ll probably be OK. I’d rather buy the renminbi directly. Even the Chinese are starting to loosen up their interest-rate structure; they have to. So interest rates in China are headed higher. You can also buy commodities because most people, myself included, find it difficult to get to know specific Chinese companies. With cotton or sugar you don’t have to worry about management teams. Sugar prices have fallen some 75% from their all-time highs. Consumption is rising as economies grow and as more people use sugar for fuel. Yes, there’s been a glut, which is why sugar farmers are producing less of it and prices are down. But you should buy low and sell high, and I’m buying sugar as we speak. Recovering sugar prices will also help companies like MSM Malaysia Holdings [MSM.Malaysia; which runs refineries and produces sugar products]. Speaking of commodities, gold is 32% off its record high of $1,921 a troy ounce. Are you buying? I own gold but I’m not buying any more at the moment. Gold went up for 12 straight years, which is an extraordinary anomaly. I know of nothing that has gone up for 12 years without a decline. So gold is now having its correction, but I’d also expect the correction to be different from normal. I’ve said in TV interviews that gold could go to $1,200, and when it did I bought some. But a 50% retracement from its peak would take gold near $960, and 50% corrections can be quite normal. Don’t forget, India is the world’s largest consumer of gold. It’s their second-largest import, after oil. They can’t do much about oil, but Indian politicians are blaming their problems on gold, and they keep putting taxes and restrictions on gold imports. I expect I might get another chance to buy more gold in the next year or two, so I’m waiting. But I’m not selling what I have, and I expect gold to go well over $2,000 eventually. What about Japan? I sold Japan in May. Yes, after it had run up. It was probably too soon, and Japanese stocks could well go up more because of all this liquidity. But I’m not at the party anymore. I’m figuring out if I should go back to the party, but I’m usually not very good at getting involved with something that I’m skeptical about. What’s the longer-term issue with Japan? The fundamental problem in Japan is demographics. If they would let in immigrants or if they would have babies, then Japan could be very exciting. But they’re not doing that, and they’ve got to stop spending money. Domestically, Japan is the world’s largest debtor nation, and [Prime Minister Shinzo Abe] says he’s going to spend even more. It’s astonishing to me that in the last decade or so, politicians all over the world have said the problem of having too much debt should be solved with even more debt! Given your concerns about artificial liquidity, what warning cues are you looking for? I’m most concerned about currency turmoil coming. Look, the yen has declined 25% [against the dollar] in less than a year, a staggering move for one of the world’s most important currencies. The euro is a fabulous concept, but its execution has been bad. And the dollar is tied to the largest debtor nation in world history. I own the renminbi. I also own the dollar, not because I have such confidence in the U.S., but because I’ve got to invest somewhere, and if turmoil comes, people will flock to the dollar. It’s not a safe haven, but it’s considered that way. I cannot invest the way I want the world to be; I have to invest the way the world is. I also own the Singapore dollar because I have expenses here. Singapore has allowed its currency to appreciate as a way to attack inflation—and it’s an export economy. It doesn’t have cotton fields or oil or natural resources, and everything is imported. The Chinese should learn from Singapore. There are 1.3 billion Chinese, and they would be better off if its currency went up, because the cost of living would go down. Yes, some people, like the exporters, would have to adjust. But remember, the Japanese yen has gone up a lot against the dollar over the decades, and Japan still has a trade surplus with the U.S. But China does things its own way, and I think this is one of their mistakes. You wrote a book about life lessons you’d like to pass on to your kids. What would you tell young Americans today? You’ve got to learn a foreign language. At least one! This is not 1953. America’s relative position in the world will continue to decline, and Americans must know about and engage the rest of the world. If I can do just one thing, I would shake up the American education system and make Americans learn more about the world. We have the largest debt in the world. The days when we can get away with not caring about the world are coming to an end. Taylor Scott International

Taylor Scott International, Taylor Scott